A Proposed Quantitative ESG Framework for Financial Companies

——Take Goldman Sachs Group, Inc as an Example

◎ HAN◎Bojing

A Proposed Quantitative ESG Framework for Financial Companies

——Take Goldman Sachs Group, Inc as an Example

◎ HAN◎Bojing

This paper takes Goldman Sachs Group, Inc as an example to propose a suitable quantitative ESG framework for all financial companies.

Overview

Inrecent years, as ESG(Environmental, Social and Governance)factors, which when integrated into investment analyses and portfolio constructions, may offer investors potential long-term performance advantages,many professional investors begin to pay more and more attention to ESG reports and take these reports as a means of helping to identify companies with superior business models. Although there are several professional rating agencies who prepare ESG reports for big companies like JP Morgan Chase,Bank of America, Goldman Sachs, and etc., none of these ratings are purely quantitative or are especially designed for financial companies (Betty Moy Huber and Michael Comstock, Davis Polk & Wardwell, July 27, 2017)[1]. As for ESG report users, a descriptive ESG report with only relative information is not practical enough when investors want to compare the ESG performances between numerous companies and it is not accurate to value various kinds of companies by using the same framework. Therefore, a quantitative ESG framework for financial companies needs to be established.

Goldman Sachs is a leading global investment banking, securities and investment management firm. It is also a company which commits people, capital and ideas to help clients, shareholders and the communities to grow. As an ethical responsible company, it edited Environmental Report from 2006 to 2010 and ESG report from 2011 to 2015.Accordingly, I choose GS as an example in my paper.

Methodology of the proposed ESG framework for financial companies

The ESG framework proposed in this paper is improved from ESG INDEX from MSCI, the world’s largest provider of ESG indexes and research.

A weighted framework

Table1.The distribution proportion for 7 criteria in the proposed ESG framework

I propose a weighted ESG criteria framework for financial companies according to the importance of these factors on the financial markets. I assume that the three most important criteria are products (35%), governance (25%), and employee relations (10%). More detailed reasons for this assumption are given in the following part.

A non-negative framework

In order to establish a framework as simple as possible, I cancel the criteria“strength and concern” used in MSCI ESG INDEX and turn it into scores ranged from 0 to 5 with an overall score of 100.

Added criteria suitable for financial companies

Besides evaluation criteria proposed in MSCI ESG INDEX, I added several criteria which are essential to evaluating the performance of companies in financial sectors, including speculative trading, Tier 1 ratio, sustainable project investment, etc.

The quantitative ESG Framework for financial companies

Product (35%)

Explanation for the proportion:

I assume the product to be the most important part of the ESG framework for financial companies because the types and the profits of the investment make the biggest influence on its consumers,shareholders, employees and society.That’s why I decide to give it a weight of 35%.

Main criteria: Speculative Trading,Tier 1 Ratio, Unsecured Long-term Borrowing, Cyber Attack, Defense,Trust Speculative trading, Tier 1 Ratio and unsecured long-term borrowing measure a financial company’s risk management ability. Investment behaviors exposed to high risks are likely to damage stakeholders’ profits.In terms of the importance of cyber attack defenses, a failure to protect computer systems and clients’information against cyber attacks and similar threats could impair its ability to conduct businesses, result in the disclosure, theft or destruction of confidential information, damage its reputation and cause losses. Trust measures the severity of controversies related to a firm’s anti-competitive business practices. Factors affecting this evaluation include a history of involvement in anti-trust legal cases,widespread or egregious instances of price-fixing, collusion, or bid-rigging,resistance to improved practices, and evidence-based criticism by NGOs and/or other third-party observers.

Governance (25%)

Explanation for the proportion:

Governance accounts 25% of the total. For a finance company who engages in investment banking, the most important thing is the ethical benchmark. It should manage the professionalism and integrity of the capital market, disclose the real information, clarify its duties to clients,and equilibrate the conflicts between the interests and the responsibilities.

Main criteria: Transparency of the Oversight, Client Care, Disclosure of Financial Reports

Employee relation (10%)

Explanation for the proportion:

Employee criteria examine how a company manages relationships with its employees. Good employee relation requires a company to donate a percentage of its profits to the community or perform volunteer work and to show a high regard for its employees’ health and safety. If employees are satisfied with their job,a company would benefit a harmony working environment. Since employee relation is a factor directly related to a company’s economic performance, it accounts for 10%.

Main criteria: Health & Safety Strength, Career Development and Training, Employee Involvement,Employee Affinity Networks

Environment (8%)

Explanation for the proportion:

I just give the environment a weight of 8%, since most financial companies can only devote to environmental friendly investment projects in an indirect way, likely choosing environmental friendly portfolios, saving office carbon footprints, etc.

Main criteria: Pollution Prevention,Clean Energy, Sustainable project,Management Systems

I delete the criteria of “products and service” and “recycling” in environment, because “products and services” of financial companies have little to do with the environment and “recycling” can be included in“pollution prevention”. At the same time, I add the criteria of “sustainableproject” because I think the concept of sustainability is becoming increasingly important to all types of companies.

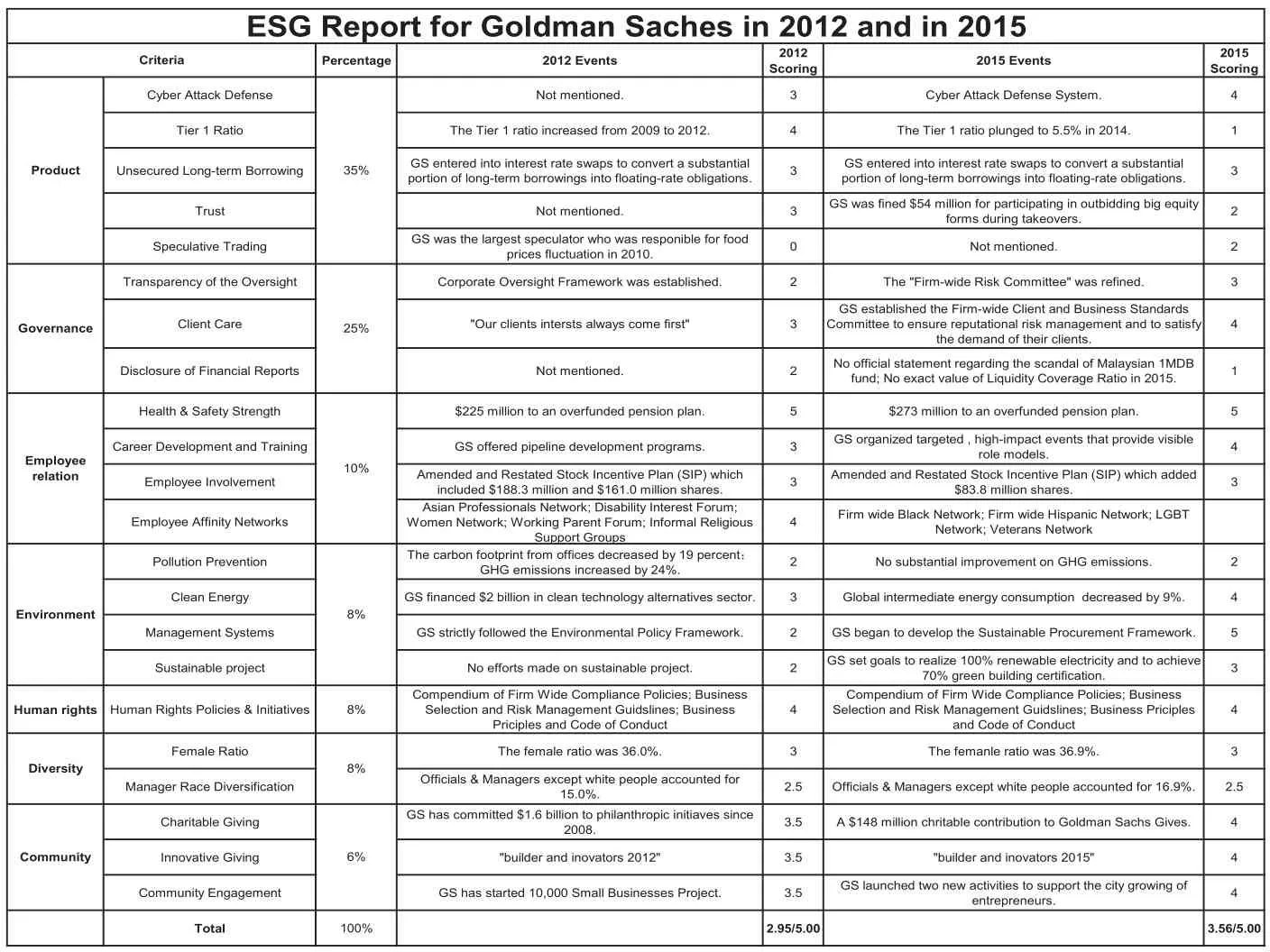

Table 2 The quantitative ESG report for Goldman Sachs in 2012 and in 2015

Human rights (8%)

Explanation for the proportion:

Human rights involve three aspects: employees, clients and vendors. Financial companies need to create a workplace that respects each employee’ human rights and to ensure that the interactions of its people with clients, vendors and other business partners comply with the spirit, as well as the values and laws in the jurisdictions in which it operates. Their respect for human rights is fundamental to their business; it guides them in how they treat and train their employees and how they work with their clients and their vendors; it helps to inform their business selection process and to guide their business decisions and judgments.Based on the importance of human rights, it accounts for 8%.

Main criteria: Human Rights Policies & Initiatives

Diversity (8%)

Explanation for the proportion:

Diversity accounts for 8% of the total framework. This aspect is mainly related to workforce diversity and director diversity, which can affect a company’s reputation and working environment. Whereas financial companies need to pay more attention on employees’ work efficiency and the company’s overall performance(economic returns), they are supposed to have special teams which suit best for the projects. That’s why diversity accounts for 8%.

Main criteria: Female Ratio,Manager Race Diversification

Community (6%)

Explanation for the proportion:

Community accounts for 6% of the whole framework. Considering that Goldman Sachs is a financial company,its clients are mainly the corporations,governments, and qualified individuals.Unlike other firms which are engaged in the real economy, the clients are concerned more about the benefits of each project rather than the philanthropythat Goldman has done. In most cases,involving in community activities can only improve the company’s reputation but merely make profits. That’s why community accounts for only 6%.

Main criteria: Charitable Giving,Innovative Giving, Community Engagement

General comments and conclusion

According to this quantitative ESG framework, Goldman Sachs got a final note of 3.56/5.00 in 2015 and 2.95/5.00 in 2012. The company has been progressing during three years, especially for“environment”, “community”,“product” and “governance”. But Goldman Sachs still has a lot to do in the future. To improve the quality and safety of their products and services, GS should persist in the effort of financial risk management and the defense of cyber attack. What’s more, GS should not only aware the importance of the relationship with its clients, but also strictly follow the regulation of supervision organization by completing its administrative structure. As one of the leaders in bank sector, Goldman Sachs needs to work harder in terms of CSR (Corporate Social Responsibility).

According to the ESG framework applied to Goldman Sachs, we can see its accuracy and convenience for evaluating all financial companies.Therefore, I highly recommend authorities to set standards for assessing the environmental, social and governance performance of all companies in financial sector.

[1] Betty Moy Huber and Michael Comstock, Davis Polk & Wardwell. (July 27, 2017). LLP ESG Reports and Ratings:What They Are, Why They Matter.[Online] Available: https://corpgov.law.harvard.edu/2017/07/27/esg-reportsand-ratings-what-they-are-whythey-matter/

[2] MSCI ESG INDEXES [Online]Available: https://www.msci.com/zh/msci-esg-universal-indexes

[3] Goldman Sachs 2012 annual report Goldman Sachs 2012 ESG report

Goldman Sachs 2015 annual report Goldman Sachs 2015 ESG report

(作者單位:中國(guó)人民大學(xué))