From All Four CornersCross-border e-commerce steps up China’s imports

By Zhang Shasha

Products displayed at the Japan booth during the China International Fair for Trade in Services, September 4, 2022. (VCG)

In a recent conference with representatives of several Pakistani small and medium-sized enterprises (SMEs), Luke Liu found they didn’t know the Chinese market well. The country has exported many mined and cotton products to China, but a lot of suppliers—e.g., those of handicrafts—felt at a loss when dealing with Chinese customers.

“While they expressed extreme interest in tapping into the huge Chinese market, they knew little about it, they didn’t understand e-commerce and they were not even aware of whether China gives access to their products,” Liu said.

As senior director of business development at JD Worldwide, the cross-border e-commerce platform of China’s e-commerce giant JD.com, Liu has attended many similar meetings, through which he has gained knowledge of the needs of merchants of all kinds from different countries. And he and his team have set out to optimize solutions.

The continuous efforts of experts like Liu have led to China’s high performance in cross-border e-commerce, which has taken off over the past five years, growing 10 times to 1.92 trillion yuan (US$269.35 billion) in 2021, accounting for 4.9 percent of the total value of imports and exports, and 3.1 percent of the imports, according to the General Administration of Customs of China.

In under one decade of development, China’s cross-border e-commerce has thrived at a rapid pace, becoming a new growth driver of imports in addition to traditional channels.

The COVID-19 pandemic further fueled its progress. “The pandemic has altered people’s consumption behaviors, stimulating online shopping demands, and China’s cross-border e-commerce took off against that backdrop,” Vice Minister of Commerce Sheng Qiuping said at a press conference in May.

With advantages in manufacturing capacity and market size, China has gained abundant experience in e-commerce and has been devoted to international cooperation, offering its solutions to the World Trade Organization, Group of 20, Asia-Pacific Economic Cooperation, and more, he added. To date, the country has signed memoranda of understanding with 23 countries on e-commerce cooperation, according to the Ministry of Commerce.

‘Dark Horses’

In 2019, JD.com decided to ramp up the online National Pavilion project, supported by foreign embassies in China, to help overseas brands enter the Chinese market. Today, it features more than 60 such pavilions.

Liu suggested the Pakistani SMEs display their products in their country’s pavilion on JD.com and offered them a lower fee for using the platform. By doing so, more niche brands will be able to meet Chinese consumers.

“Some brands boasting geographical advantages and using unique raw materials are of high-quality and very popular in domestic markets, but fail to gain wider recognition, so we team up with local government organs, trade associations, consulting firms, and so on, to explore and purchase [goods] from all over the world for Chinese consumers,” Liu said.

Apart from brands that come from countries Chinese consumers are more familiar with, for example those from China’s major import sources such as the U.S., Britain, Japan and the Republic of Korea, up-and-comers in the Chinese market include the likes of Malaysia and Denmark, he said. “If only going by growth rates, imports from those countries grew faster than those from traditional source markets.”

In recent years, many previously lesser-known foreign brands have risen to prominence in China’s consumer market. Liu attributes their newfound status to the novelty-seeking nature of customers.

This year, JD’s 618 Grand Promotion, an annual mid-year online shopping festival, saw Cuban honey and rum products selling very well, Liu said, adding that brands from other Latin American and Caribbean countries such as Chile, Peru and Colombia also boast great potential.

Cross-border transactions of products from the Cuba Pavilion ranked third during the shopping carnival, right after those of Finland and Singapore, according to JD.com. In addition, sales registered from the France, Hungary and Singapore pavilions surged 194, 147 and 141 percent year on year, respectively.

Brand-new Import Model

Sheng spoke highly of the role of cross-border e-commerce platforms at the press conference, referring to them as “world-leading players.” While serving as a bridge between overseas quality goods and the huge market of China, they are improving the global e-commerce ecology.

Take the example of cubilose, the salivary secretion different swift species use to make their nests and used as a food item in Asian cuisine—said to boost one’s beauty and health. This was a more unusual product to come by in China due to limited supply. Chinese consumers had to hunt down the “precious tonic” from some Southeast Asian countries—at a substantial cost.

Consumers in those countries, however, were already enjoying the convenience of cubilose extract packaged in small portions for daily use. But time became an obstacle to import because it took up to two weeks for the suppliers to transport their products from, for example, Malaysia to China. Plus, the ready-to-use extract only has a shelf life of 15 days.

Things have changed since Tmall Global, Alibaba Group’s dedicated channel for cross-border e-commerce, in 2020 initiated a model called the New World Factory, which allows overseas brands to relocate the final processing and packaging stages from their home countries to China’s comprehensive bonded zones (CBZs).

The model gives full play to the role of the CBZs, special customs supervision areas with preferential taxation and foreign exchange policies that are home to firms mainly engaged in export manufacturing and logistics. In April 2020, the government expanded the pilot policy of selective tariffs on domestic sales to these zones. The policy allows manufacturers operating in bonded warehouses and selling their products to the domestic market to declare their products either as imported raw materials or as finished or partly finished products, depending on their assessment of the convenience and the tax pressure on their companies.

Under the new model, PT Swift Marketing Sdn Bh, a Malaysian corporation that integrates the complete chain of bird’s nest ranching, built its new factory in one of the CBZs in Xiasha District of Hangzhou, Zhejiang Province. It can store the raw cubilose in its Chinese factory in advance, workers begin production the day they receive the orders, and no later than the following day can consumers get a taste of the fresh extract delivered to them directly from the bonded zone.

“Chinese consumers boast strong demand for imported goods of short shelf life like cubilose extract, but the traditional cross-border supply chain failed to meet their new requirements,” Yu Xuhai, head of the New World Factory project, said, adding that “the new model shortens the period of supply and creates a brand-new import model.”

To date, Tmall Global has cooperated with six CBZs, including the Hangzhou CBZ, Suzhou CBZ in Jiangsu Province and Haikou CBZ in Hainan Province, the goods ranging from cubilose, coffee, pet food and cosmetics to daily chemical products.

An Ocean of Trade

The Chinese government has fostered a favorable environment for the development of cross-border e-commerce, according to Yu. While giving full play to government policies, Alibaba has been fulfilling its commitment proposed at the First China International Import Expo in 2018 to import US$200 billion worth of goods within five years. The past three expos have seen the multinational tech company beat the phased targets.

“In recent years, the government has rolled out preferential policies on tax and logistics to cut costs for entering the market,” Liu said.

In February, China’s list of imported retail goods for cross-border e-commerce added 29 product categories, including ski equipment, tomato juice and golf equipment. Released in 2016, the positive list has seen several adjustments, and the number of authorized categories has continued to increase, according to the Ministry of Finance. The newly added items are basic goods that have become more popular among Chinese consumers, proving the policies are in line with changing consumer demands.

“Over the past years, quality-oriented consumption has become the theme of China’s import market,” Liu said, adding this upgrade is characterized by more personalized and diversified demand. Apart from the big three cross-border import categories—cosmetics, maternity, child and healthcare products, plus pet-related goods—the popularity of personal care and digital products has been on the up.

These new features indicate the upgraded consumption demands of the Chinese people and will shape China’s cross-border e-commerce and import at large in the next decade, Liu said.

- China Report Asean的其它文章

- Capturing ‘Ghost Gear’Discarded fishing gear continues to “fish” as the ocean’s silent killer

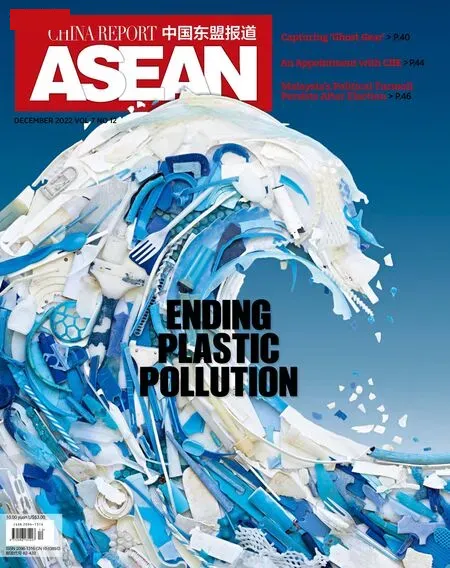

- Ending Plastic Pollution

- Embracing The ‘Asian Moment’

- CELEBRATING THE 55TH ANNIVERSARY OF ASEAN China and ASEAN pursue common development through solidarity and mutual assistance

- CHINA’S NEW ECONOMY TAKES OFF The goal is to build a modern socialist economy with Chinese characteristics

- A Century of Chinese Animation Drawing a path with Chinese characteristics