TFY 2022:Highlights in Upstream Business

World supply was pushed by manmade fibers but century’s average annual growth rate was missed in the third consecutive year and adverse conditions prevailing make a return to the long—term growth path rather highly disput—able in 2022.

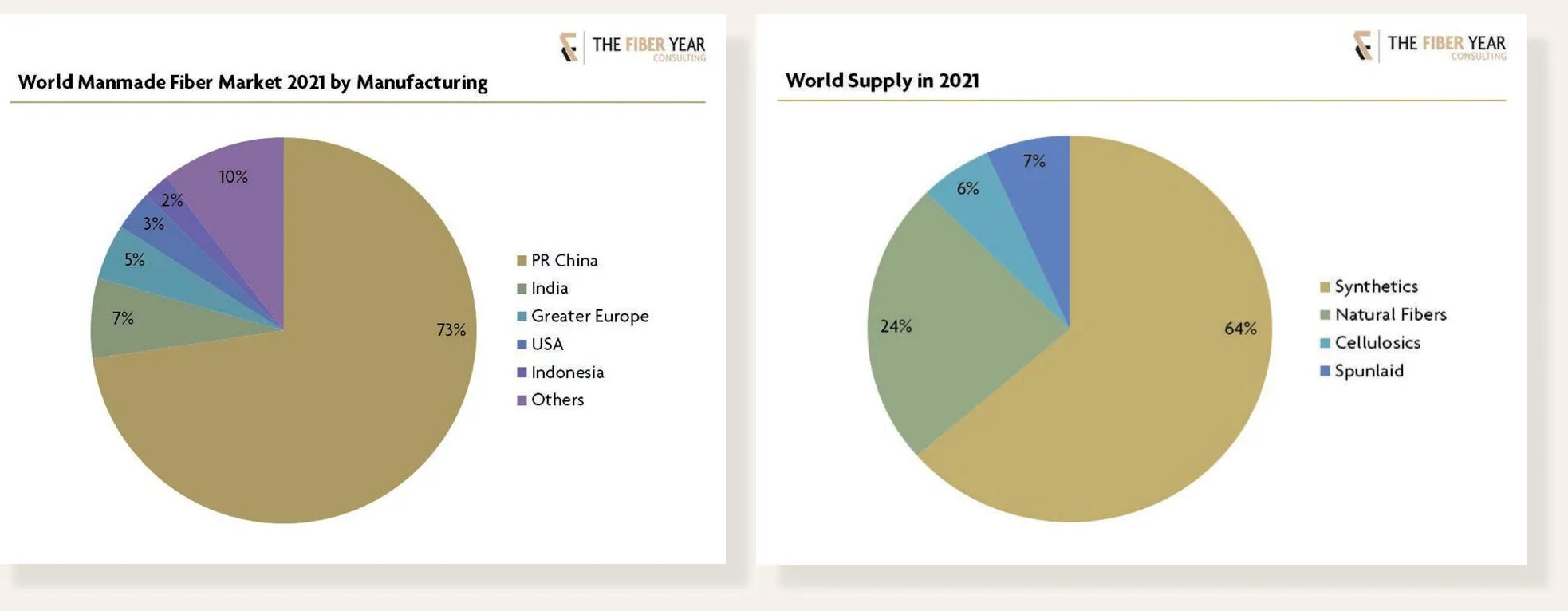

Global supply rose less than 4% to 127 million tonnes,equal to an average 15 kg per capita consumption.The largest segment with 64% share comprised synthetic fibers with both mainstream types polyester and nylon expand—ing almost 10% each,polypropylene inching up 1% and acrylic fibers contracting in the tenth consecutive year by 2%.Growth was further visible in small—scale segments such as aramid,carbon and spandex fibers.

The second—largest sector with 24% share included natural fibers with last year’s sharp declines in cotton and flax production due to pandemic—induced inventory accumulation in the year before.Cellulosic fibers,eldest man—made fiber derived from essentially wood,are in the midst of a multi—decade growth phase and marked a new all—time high,occupying at pres—ent 6% share.They experienced gains across the board and the fastest growing fibers were modal and lyocell at distinct double—digit rates each.Finally,spunlaid nonwovens declined as expect—ed for the first time in 3 decades.Outsized hygiene demand in 2020 led to 7% decrease and their ratio in world supply accounted for almost 7%.Most global sources refer to the fiber size only but a market size of spunlaids at more than 1 kg per capita consumption by now should not be neglected.

Although performance in 2021 was mostly char—acterized by positive growth,it certainly was not a broadly based recovery and a return to the long—term growth path appears ambitious for this year.In fact,geopolitical instability,adverse economic and logisti—cal conditions prevailing make this target rather highly disputable.Century’s average annual growth rate amounted to 3.8% with supply under performing in the third consecutive year,thus,an accumulated vol—ume of almost 8 million tonnes was lost.World busi—ness will lose another year of growth as a calculated 7% expansion to go back to the long—term growth rate appears out of reach.

World supply was lifted thanks to 9% expansion of manmade fibers that currently hold an almost 70%share.In regional terms,the top—5 manmade fiber producing countries with Greater European region in—cluding all European states,Turkey and CIS countries amounted to a 90% share.

Chinese industry recorded 8% growth to 64 mil—lion tonnes to reach new all—time high following strong gains in polyester,nylon and spandex while polypropylene modestly rose and acrylic fibers continued their 5—year contraction.

A similar growth rate was realized in India to arrive at 6 million tonnes,which still was below 2018/19 levels due to the weak polyester busi—ness while nylon and wood—based cellulosics hit new peaks each.

Greater Europe experienced 11% rebound to 4 million tonnes thanks to above—average in—creases in Turkey while 27—nation EU improved but remained at second—lowest level in the quota—free period.U.S.industry expanded 8% to 3 million tonnes even if labor shortage and ex—tended lockdowns in Caribbean region prevented higher operating rates.

Indonesia witnessed 18% boost to 2 million tonnes,which was rather a technical reaction after a steeper contraction in the year before.Remaining industries succeeded to grow by 11% to 9 million tonnes.In total,the world beyond China jointly rebounded at faster pace by almost 11% to just re—turn to pre—pandemic level.Improvements,essen—tially in Europe and U.S.,were partly based on high freight costs,port congestions,supply disruptions and not calculable delivery times that hamperedproduction scheduling with sourcing policy in Asia.

For the first time ever,the segment of wood—based cellulosics was subdivided by spinning process in The Fiber Year 2022 report.Dynamics for essentially wood—based lyocell fibers came to temporary halt in 2020 but bright prospects for future growth quickly returned late 2020 already and are projected to remain in place at potentially accelerated pace indicated by global investments,superior fiber properties including biodegradability,growing aware—ness of plastic waste from oil—based fibers and of consum—ers for environmentally safe clothing,improved security of supply over natural fibers and sheer limitless raw material supply,which became increasingly important given a large number of technical issues and force majeures at synthetic fiber feedstock industries with occasionally tight markets limiting spinning operations.

The entire business saw previous year‘s output re—covering 7% to 7 million tonnes thanks to manufacturing exceeding pre—pandemic levels in most industries across the globe except for China,and Japan.Double—digit growth rates were noticeable for specialty fibers such as lyocell and modal as well as viscose filaments while regular and eco—friendly fibers came close to pre—pandemic level after growing 6% and acetate tow realized growth despite slow—ing in prime market of cigarette filters but benefiting from expansion in textile end—uses.

- China Textile的其它文章

- Heimtextil Trends 23/24 define the future of home textiles

- Vietnamese textile,garment,footwear firms see drop in orders

- Pakistan exported highest ever$19.35 billion worth of textile products

- Evolution 3,the best washing machines ever

- Future-proofing your textile business

- Lightbulb moments continue for James Heal