FOREIGN INVESTMENT LAW: A RADICAL REFORM

By Han Caizhen

The widely discussed Foreign Investment Law of the People's Republic of China was adopted at the second session of the 13th National People's Congress,China's national legislature, and will come into force on January 1, 2020. It is considered the most important law on opening-up since China's entry into the World Trade Organization. Passage of the law represented a new move for China to continue its opening-up,demonstrating the country's active attitude toward promoting higherlevel opening-up and heralding radical reform of its foreign investment administration system.

Outdated ‘Three Laws Concerning Foreign Investment’

In the 1970s and 1980s, to cater to the needs of opening-up, China consecutively formulated and enacted the Law on Chinese-Foreign Equity Joint Ventures, Law on Foreign-Capital Enterprises and Law on Chinese-Foreign Contractual Joint Ventures,collectively known as the “Three Laws Concerning Foreign Investment.”These laws filled in some blanks in China's foreign investment rules and have guided practice of attracting foreign capital over the following decades.

However, after establishment of China's new export-oriented economic system and considering the current comprehensive opening-up landscape,the “Three Laws Concerning Foreign Investment” have become outdated.

The “Three Laws” are essentially separate corporate laws for different forms of foreign-invested enterprises rather than a unified law. As a result,different kinds of enterprises don't enjoy equal legal status. Moreover,due to the lack of unified sectoral law that elaborates on general provisions regarding introducing foreign investment such as tasks, basic principles and fundamental systems, it is hard to effectively implement China's basic policies on foreign investment.

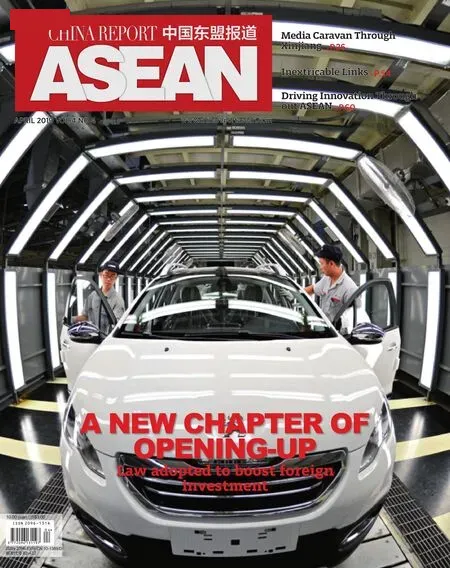

Workers assemble cars on a production line of the Dongfeng-Renault factory in Wuhan City, Hubei Province.

Furthermore, those individual laws were formulated and promulgated by different departments at different times, so they hardly work with each other, and provisions on some matters are repeated in these laws.

Moreover, the laws concerning foreign investment do not fully align with some domestic laws. For instance,the Corporate Law of the People's Republic of China is a fundamental law regulating corporate enterprises in the country. From the perspective of jurisprudence, matters concerning foreign-invested enterprises should be subject to corporate law, and relevant laws are supposed to complement and agree with each other. But in fact, many contradictions and conflicts exist in practice, confusing the corporate law with the foreign-invested enterprise law and bringing difficulties to enforcement of the laws. This also considerably impedes the introduction of foreign investment.

China's current laws concerning foreign investment are oriented towards business organizations. This approach has proven outmoded with the country's economic development and deeper reform. Those laws define foreign-funded enterprises based on the nationalities of their investors, which can result in “fake foreign investment.”For example, a domestic enterprise can set up a subsidiary abroad and then invest in China to build a socalled “foreign-funded” enterprise or a joint venture with its domestic parent company to enjoy preferential policies for foreign-funded enterprises.

Since 2012, China has established 12 pilot free trade zones including the China (Shanghai) Pilot Free Trade Zone and adopted the management model of pre-establishment national treatment plus a negative list for foreign investment. Furthermore,it transformed the full-chain examination and approval system that had been used for decades into a management system combining limited approval and notifying registration. In this context,formulating a fundamental law on foreign investment that incorporates many legalization processes of strategic value will provide new guidance and instructions in practice while showing China's determination and confidence in broadening its opening-up.

The Foreign Investment Law is a fundamental law, and many parts of it are principal and macro provisions.

Clarifying Important Matters

The recently passed Foreign Investment Law systematically legalizes the Chinese government's administration of foreign investment the following ways:

First, it confirms the management model of pre-establishment national treatment and a negative list for foreign investment. This helps create a more stable and predictable business environment for foreign investors. In the past, China adopted an examination and approval approach on a case-by-case basis and the Catalogue of Industries for Guiding Foreign Investment for the management of foreign investment. It was uncertain whether foreign investors could invest in projects not included in the Catalogue and whether they would pass the examination and get approval.The “negative list” management system means that market entities are entitled to invest in businesses not on the list,and the government cannot intervene unless otherwise stipulated by law.Except for areas that require specific entry permissions, foreign investors can set up businesses by registration rather than by examination and approval procedures. The government's intervention with market entities is restricted to the negative list. This substantially improves the stability and predictability of the investment environment.

Second, it confirms that domestic and foreign firms enjoy equal rights.For instance, all policies adopted by the state to support enterprise development are also applicable to foreign-invested enterprises. Foreigninvested enterprises enjoy equal rights to participate in standards formulation and government procurement. The formulation of standards should emphasize information transparency and public supervision, and mandatory standards shall be equally applicable to foreign-invested enterprises. In addition, products manufactured by foreign-invested enterprises in China shall be treated equally in the process of government procurement.

Otmane from Algeria was granted a business license the same day he applied in Jinhua City,Zhejiang Province, on August 11, 2016.

The groundbreaking ceremony of the TeslaGigafactory, the largest-ever foreign investmentproject in Shanghai, is held at the Lingang Industrial Area on January 7, 2019.

Third, it strengthens the protection of property rights of foreign-invested enterprises. Generally, the state cannot confiscate foreign investment. If such confiscation is necessary for the sake of the public interest, it shall be carried out according to legal procedures and relevant investors shall be given fair,reasonable compensation. Invested funds, profits and capital returns of foreign investors can be transferred in and out of China in the form of RMB or foreign currencies according to law. The state protects intellectual property rights of foreign investors and foreign-invested enterprises by law,encourages technological cooperation based on the principle of free will and relevant business rules. The terms and conditions of technological cooperation shall be determined through consultation between involved parties, and the government shall not use administrative measures to force technological transfer.

Fourth, it reinforces the restriction on the formulation of regulatory documents concerning foreign investment and urges local government to fulfill its commitments.The Foreign Investment Law stipulates that the government and relevant departments shall formulate regulatory documents concerning foreign investment according to relevant laws and regulations and shall not unlawfully reduce or undermine legitimate rights and interests of foreign-invested enterprises, increase their obligations, set up market entry and exit restrictions, or intervene or impact the normal production and operation activities of foreign-invested enterprises. It also stipulates that local governments at all levels and relevant departments must strictly fulfill their commitments to policies and all kinds of contracts signed by law. If such commitments and contracts need to be altered for the sake of national or public interests, such changes must be performed according to statutory authority and procedures, and foreign investors and foreign-invested enterprises shall be compensated for losses arising from this.

Finally, it improves the complaint and right protection mechanism. The Foreign Investment Law stipulates that the state shall establish a foreigninvested enterprise complaint mechanism, coordinate and improve major policies and measures concerning the complaints of foreigninvested enterprises and address their complaints in a timely manner.Foreign investors and foreign-invested enterprises can establish or voluntarily join relevant chambers of commerce or associations according to law to safeguard their legitimate rights and interests.

New Requirements for Governance Capacity

In the past, China adopted an examination and approval system for foreign investment which was a presupervision approach. As it began to adopt a registration system, pressure has mounted for the government to innovate its administration methods and shift to interim supervision and post-supervision.

According to the Foreign Investment Law, the tools that the government may use to administer foreign investments include a negative list, industrial permit, organizational, tax, accounting and foreign exchange administration,anti-trust investigation, information reports and foreign investment security examination. Information reports and security examinations bring new requirements for China's governance capacity in this new era. For instance,establishing the information reporting system aims to comprehensively measure the overall situation of foreign investment through information gathering and data analysis. Alongside information about funds and operation,the system places particular attention on information such as the actual controllers, invested industries and invested regions of foreign investment.

In their annual statistical reports,foreign investment administrative authorities will place priority on analyzing business attributes and social in fluence of foreign investment to provide references for the formulation of relevant policies.This raises the requirements for the government's capacity in information and data collection, statistics and analysis.

The Foreign Investment Law is a fundamental law, and many parts of it are principal and macro provisions.Therefore, relevant implementation of rules and clear judicial interpretations need to be formulated in a timely manner to ensure the law is effectively enforced in practice.