Should We Stay or Should We Go? What multinationals should look for as they decide to keep production in China or move it to ASEAN countries

By Wu Xiaole

Should We Stay or Should We Go? What multinationals should look for as they decide to keep production in China or move it to ASEAN countries

By Wu Xiaole

About the author:Wu Xiaole is an associate professor at the Fudan University School of Management.

The decision-making of enterprises on whether to remain or transfer production to another country is a complicated process, which involves a number of factors, including the cost of labor, the size of the potential market and the uncertainty of cost.

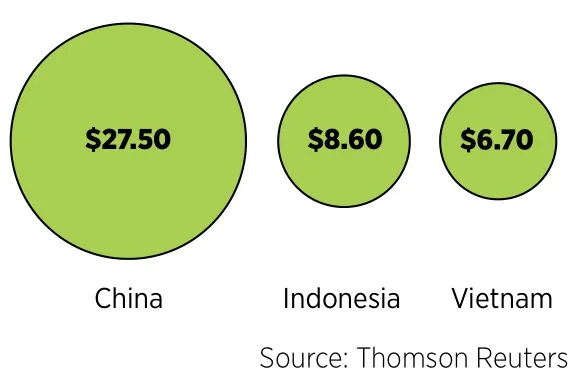

Daily Average Wage of Factory

Workers, 2015(US Dollars)

Still The ‘World’s Factory’?

Some multinationals are switching production from China to ASEAN countries with cheaper labor costs

Once considered “the world’s factory”, China has attracted a lot of foreign investment over the past several decades. Therefore, many Chinese factories have served as the suppliers of a large number of multinational firms. However, in recent years, with the dramatic rise of labor costs in China, many enterprises are having second thoughts about their global procurement strategies. These days, ASEAN countries with lower labor costs are a more attractive option.

Statistics published by The Economist show that the average daily wage of a Chinese worker in 2015 was US$27.50, far more than the US$8.60 of an Indonesian worker and the US$6.70 of a Vietnamese worker. Although the low labor costs in ASEAN countries are attractive, potential problems associated with industrial transfer, notably intangible costs, cannot be neglected. The McKinsey Global Institute (MGI) has pointed out that ASEAN’s import and export costs (tariffs, port surcharges, inland transportation charges and other costs) are 24 percent higher than that of China, and its whole process of import and export takes 66 percent longer than the OECD average, indicating fairly low ef ficiency. In addition, ASEAN has high non-tarif f barriers associated with electronic products, consumer products and the automotive industry. Its infrastructure is relatively weak compared with that of China.

Where, then, should enterprises make purchases or set up factories?

The decision-making of enterprises on whether to remain or transfer production to another country is a complicated process, which involves a number of factors, including the cost of labor, the size of the potential market and the uncertainty of cost.The following is this author’s analysis of the main factors for enterprises’reference.

The rise of labor cost in China.The rising labor cost in China is not favorable for the enterprises operating in China currently. That’s why some enterprises have decided to transfer production to ASEAN countries. However, studies have shown that if the cost rise in China is moderate, and some enterprises have turned to purchase from ASEAN suppliers, then there are benefits for both the enterprises that have stayed in China and those that have transferred to ASEAN. That is because the rising cost has gradually deducted the advantages of purchase in China. However, when this rise is under control, it can be digested in other ways. Transferring might not be the best strategy. That means when the costs have risen moderately, enterprises don’t have to follow others. It’s likely a win-win decision for some enterprises to transfer to ASEAN while others continue to stay in China.

The size of the potential market.The size of the potential market has an impact on enterprises’ selection of suppliers. When the potential market grows, ASEAN suppliers’ lower average costs appear more attractive. On the other hand, China itself is a huge potential market. If an enterprise intends to perform well in the Chinese market, it will naturally be more inclined to purchase in China. That is tosay, if an enterprise is to focus on the Chinese market, it is best for it not to transfer but to continue with its cooperation with the Chinese suppliers. For an enterprise that intends to open up its markets outside China, it can consider the start of a brand new journey by transferring to ASEAN. If the enterprises’ market covers various regions, then the competing enterprises can adopt a differentiation strategy, when some enterprises continue to purchase in China while others transfer to cooperate with ASEAN suppliers.

A worker tests a robotic arm at a factory in Foshan, Guangdong Province in May 2015.

The uncertainty of cost.Compared with Chinese suppliers, ASEAN suppliers provide lower average purchasing costs. Since ASEAN infrastructure is not perfect, there exists an uncertainty associated with that cost. At present, in order to attract foreign investment, authorities in ASEAN countries are investing in infrastructure construction and law and regulation improvements to reduce risks and uncertainties. With frequent cooperation and indepth exchanges between enterprises and local suppliers, the uncertainty of cost is bound to gradually reduce. However, with reduction in such uncertainty, competitors can more accurately forecast the operation decisions of enterprises. Competition is likely to be increasingly fierce. The relative advantages of enterprises may be gradually diluted. On the other hand, the reduction in uncertainty is not favorable for suppliers, since enterprises will be in a better position to control suppliers. In summary, the reduction in the uncertainty of costs in the ASEAN region is likely to either increase or decrease the attractiveness of suppliers.

When the uncertainty of cost is at a high level, transferring to ASEAN will bring about a large negative impact, reducing the income of enterprises. If the current uncertainty of cost in ASEAN is at a low level, with the further decrease in uncertainty, it will be an optimal strategy for enterprises to choose to cooperate with ASEAN suppliers, because the decrease in the uncertainty will bring about high positive effects. When the uncertainty of cost is at a medium level, with the decrease in uncertainty, it’s best for enterprises to choose suppliers in the same region, especially in a fairly large market, where enterprises should maintain the original procurement strategy and choose Chinese suppliers. If it’s a relatively small market, companies should choose to transfer to ASEAN suppliers.

In this environment of a global supply chain, the complexity of procurement strategy is self-evident. In decision-making, different enterprises take into account various factors. Some seek low costs, transferring to the developing economies of ASEAN; others seek new technology, returning the manufacturing industry to developed countries; still others seek market demand, setting up factories in China. This author hopes that when looking to change their global procurement strategy, enterprises should not simply look at explicit costs, nor follow others blindly. They should take into consideration the risks and uncertainties of cooperating with factories in developing economies. From this perspective, procurement in ASEAN and China can be mutually complementary with winwin results.

- China Report Asean的其它文章

- Tourism Set to Drive Indonesia’s Economy Forward

- Brunei Envoy Pays Tribute To the King of Boni

- Lost in Vietnam: A Co-Production Love Comedy

- Cycling in Hainan A New Avenue For Tourism

- Bambang Susantono: Infrastructure Development Requires Efforts From All Sides

- Singapore and China: Building on the Past and Opening a Way Toward the Future Exclusive interview with Singaporean Ambassador to China Stanley Loh